Business Insurance in and around Los Angeles

Calling all small business owners of Los Angeles!

Almost 100 years of helping small businesses

Coverage With State Farm Can Help Your Small Business.

Small business owners like you wear a lot of hats. From product developer to social media manager, you do whatever is needed each day to make your business a success. Are you a painter, an acupuncturist or a physician? Do you own a dry cleaner, an appliance store or a janitorial service? Whatever you do, State Farm may have small business insurance to cover it.

Calling all small business owners of Los Angeles!

Almost 100 years of helping small businesses

Customizable Coverage For Your Business

The passion you have to serve your customers is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Leisha Willis. With an agent like Leisha Willis, your coverage can include great options, such as commercial auto, business owners policies and artisan and service contractors.

Since 1935, State Farm has helped small businesses manage risk. Visit agent Leisha Willis's team to discuss the options specifically available to you!

Simple Insights®

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

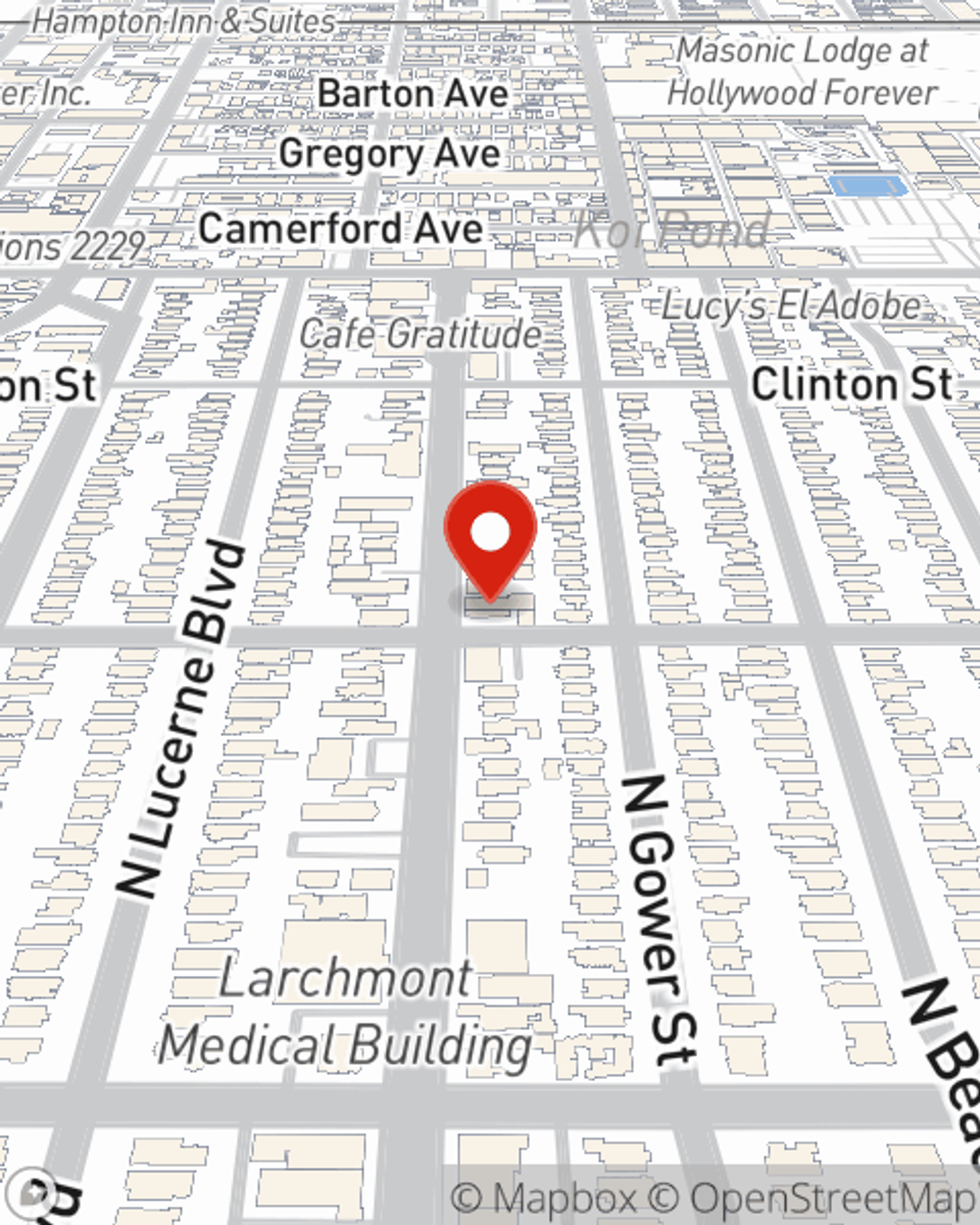

Leisha Willis

State Farm® Insurance AgentSimple Insights®

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.